Ethiopian failure to deal with a failing economy worsens the credit crash and severely limits possibilities for further international loans to support the government. Despite promises to cooperate with foreign lenders no progress has been made. There is a growing possibility that the Ethiopian federal government may collapse.

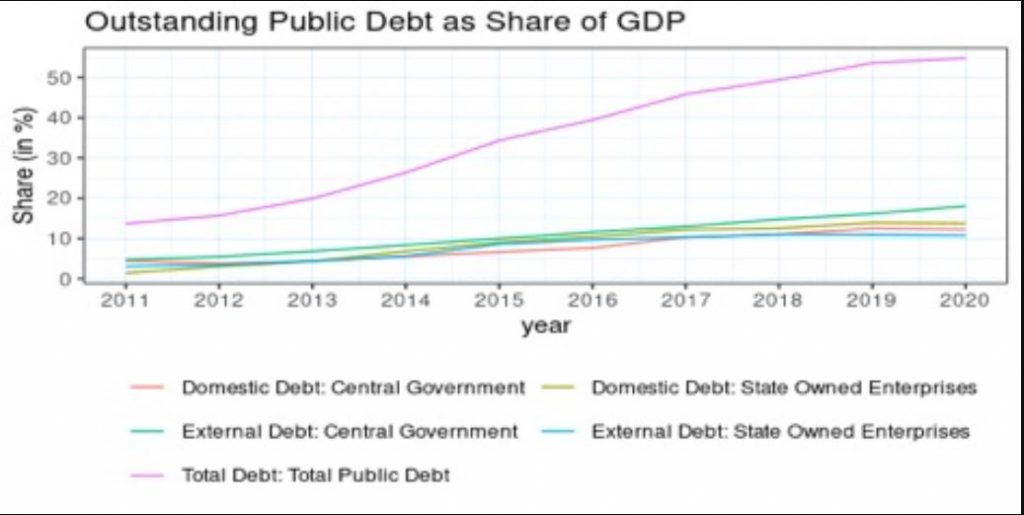

In February 2021 under an agreement called the Common Framework for Debt Treatment Ethiopia agreed to work with the International Monetary Fund to find a way to renegotiate its debt payments. Currently the Ethiopian government is estimated to be $40-$50 billion in debt for loans to the Ethiopian Federal government as well as “hidden” loans backing private businesses deals in targeted industries. This means Ethiopia currently has to pay more than $ 2 billion annually in debt service. The debt service may now be almost 50% of the Gross Domestic Product which is five times higher than the normal upper acceptable limit of 10%.

The Ethiopian government was supposed to come to terms with a committee which included France and China starting in September but so far according to Mood’s Investment Services report that came out today there has been no progress. As a result Moody’s downgraded the credit rating once again to Caa2. Their assessment is that the Ethiopian economy has a negative outlook and now has no likely source at this time for obtaining any further loans.

Moody notes weak government, poor control of COVID 19, increasing political unrest and war, drought, locust outbreaks, inflation, and loss of foreign investment interest among the factors making economic growth and stability unlikely for Ethiopia in the near future.