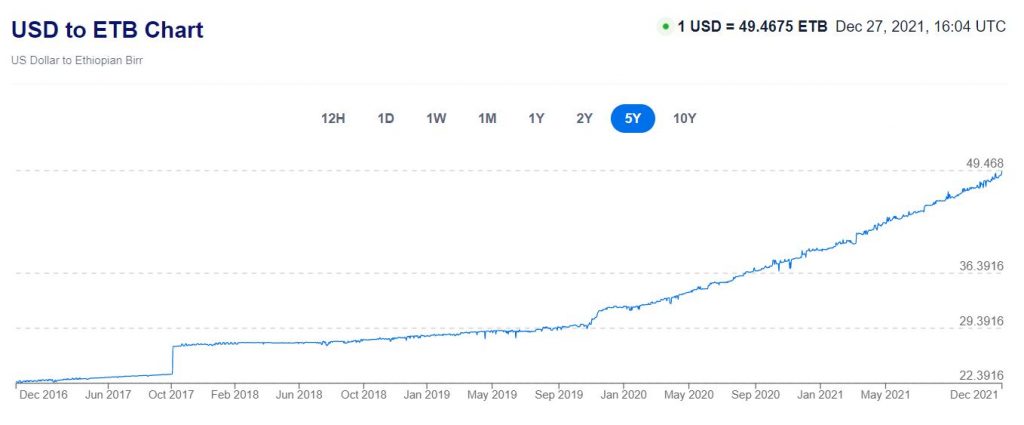

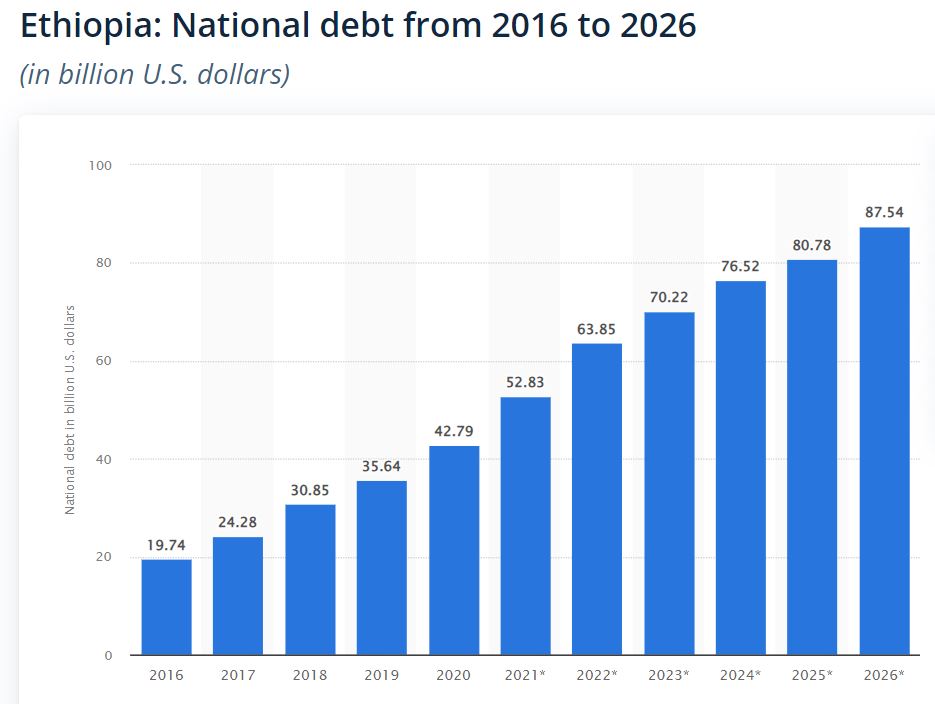

The Addis Ababa newspaper, The Reporter, this week discussed an unusual paradox being seen in the collapsing Ethiopian economy due to the rapid birr devaluation and instability due to the ongoing war. Simply put the wealthy are grabbing up high value assets while the poor and middle class are struggling just to meet daily needs. Amin Abdella (PhD) long time researcher as well as sectorial director at the Ethiopian Economics Association described how those with access to wealth in the form of foreign currency are buying up cars, buildings, real estate to liquidate their birr. He called it a “property craze”. This may explain why many wealthy Amhara in the country still support Abiy Ahmed as they are partaking of this temporary bonanza and do not yet comprehend it cannot last. The failure of the Ethiopian government under Abiy Ahmed to seek peace is continuing to devastate poor and middle income families..

Whilst the cost of living has reached record increases approaching 50% for many needs of daily living over the past two years causing the poor and middle class to struggle in paying rents, buying foods, fuel for their vehicles, and other essentials. Meanwhile the wealthy who have foreign currency assets are buying up real estate, cars, and other assets to the extent that it is driving inflation even higher. This abandonment of the birr is making the economy even worse. Even if the war stops today it will take years to recover the economy.

To make things worse, experts say investors’ disinterest in keeping their money in birr is already wreaking havoc on the whole economy.

“The price bubble does not stop at property. It has a domino effect on other services and goods,” … “The economy is in its worst shape and is now like a car that has lost its brakes.”