A complete collapse of the Ethiopian economy comes closer to reality each passing day. The calamity this would bring in terms of literally total loss of human necessities for survival for most Ethiopians may ultimately be the cause for an end to the war. Will the Ethiopia Tigray conflict end due to peace talks, military victory, or collapse of the Ethiopian economy?

The government of Abiy Ahmed remains fixed to its position it will not negotiate with “terrorists” even though it is suffering progressive defeats and loss of territory. The Ministry of Finance is releasing optimistic economic forecasts being sternly questioned by even economists who are ardent government supporters. At the same time international financial institutions and Ethiopian economists are sounding the alarm that the war costs are bringing the country to a financial collapse. Ethiopia has received less than $500 million in loan disbursement this year while spending $1 billion in payments to Eritrea and 51 million to Turkey. Amounts for other weapons are unknown at this time. The United States and European allies are clearly indicating tough sanctions will happen if no progress to peace is made.

Over the past several weeks the armed forces of Eritrea and Ethiopia have been retreating from advancing Tigray and Oromo Liberation Army forces. Economic activity remains stalled in Tigray as well as much of the Oromo and Amhara regions. Today the large Amhara city of Dessie is surrounded, Gondar has lost all communication, and Tigray forces are 150km away from Bahir Dar. In an attempt to slow the advance of the Tigray forces into western Ahmara the Ethiopian National Defense Force destroyed a strategic bridge at Ibnat. Military analysts at this time do not predict a speedy end or that the Tigray will be defeated.

According to the Ethiopian Ministry of Finance the total foreign and domestic debt incurred by Ethiopia is $55.6 billion (USD). In just the last year in great part due to the war effort but also affected by COVID and poor agricultural prices the debt has nearly doubled. Out of this more than half is debt owed to foreign lenders. Within the last year the government has paid $1.8 billion debt service payment The country’s gross domestic product was $1.4 billion but it had to pay interest on loans in excess of $1.8 billion.

Since Abiy Ahmed assumed power the percentage of the gross domestic product used to pay interest has gone from 20% to over 33% of the GDP. Some are predicting the debt cost will go to 70% of GDP and the total debt could easily double. Although Ethiopia is one of the top ten producers in the world of many grains abnormal rains, locusts, inflation, war, and displacement have reduced its agricultural output. Additionally food imports since Abiy took office have been increasing rather ten decreasing. Combining lessening high quality food exports with the need for more imports is leading to forecasts of greater food dependence of foreign aid. Before the war 25% of Ethiopians were dependent on foreign food aid. In Tigray more than 90% have been assessed as needing food aid. Now with millions displaced the number has certainly increased.

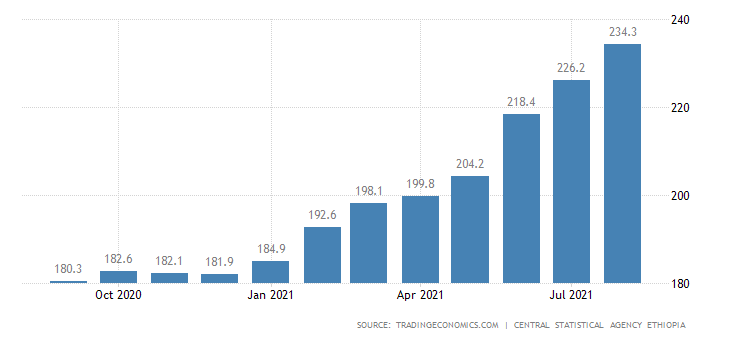

The Ethiopian government is trying to slow down inflation now at 45% for this year alone based on the Consumer Price Index by buying wheat and forcing banks to put more deposits in the central bank. Even so many Ethiopian economic experts say that even if the war stopped tomorrow it would take 10 years or more for an economic recovery assuming 5% percent or more economic growth yearly could be obtained instead of the -2% this year.