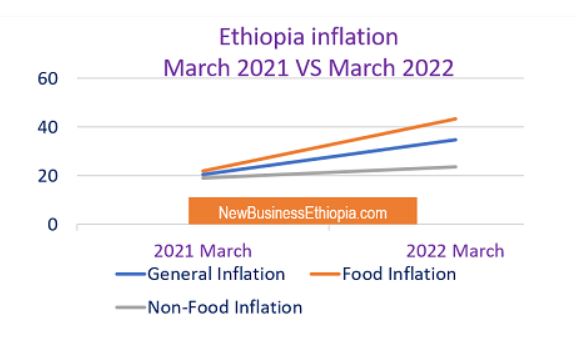

While commitment to continue government loans is being drastically cut by foreign lenders Ethiopian inflation continues to grow monthly reaching 34.7% in March 2022. The major lender of 2021, World Bank International Development Association, gave $3 billion in 2019-2020 pre-war then $1.4 billion 2020-2021, and now drastically reduced the amount this year to $774 million. Ethiopia can barely keep up with the almost $2 billion in debt payments of just interest to the foreign lenders which just about equals what used to be its overall government budget.

The unresolved Ethiopian Tigray conflict, Oromo rebellion, news actions against previous supporters such as in the Amhara region, poor crop yields requiring more than 25% of food needs be imported, and falling birr value against international currencies are among the many things adding to an uncertain future for the Ethiopian economy. This contrasts greatly with the decade of 10% annual growth that preceded Ethiopian Prime Minister, Abiy Ahmed, coming to power in 2018 and pursing conflict with Tigray, Oromo, and others.

Although the Ethiopian government gives a false explanation that loans are being decreased because “projects are nearing completion” the reality is that the failure to find peace and stability is driving lenders and investors away from Ethiopia. Loans payments were temporarily reduced by $116 million by the Group of 20 countries when the Ethiopian government promised timely resolution of the conflict and disunity. Currently there exists no progress for a new loan agreement on the Ethiopian government’s official debt which does not include government guarantees of private loans from foreign entities which may increase the total debt upwards of $60 billion or more by the end of this year.